Market intelligence platform Santiment suggests Ethereum’s institution-dominated supply distribution spells long-term bullish sentiments for the asset.

Supply distribution is a crucial tokenomics element for cryptocurrencies. For context, the more evenly distributed an asset is, the less impact its price will suffer from whale selloffs.

However, this reality changes when institutions enter the game. A crypto asset with more institutional adoption has long-term security and higher chances of continued uptrends.

On this front, data from Santiment has revealed a bullish supply distribution for Ethereum. The second-largest cryptocurrency by market cap has over 57% of its supply locked among institutions, a long-term bullish narrative for the altcoin king.

Ethereum Whale Holdings Hit All-Time High

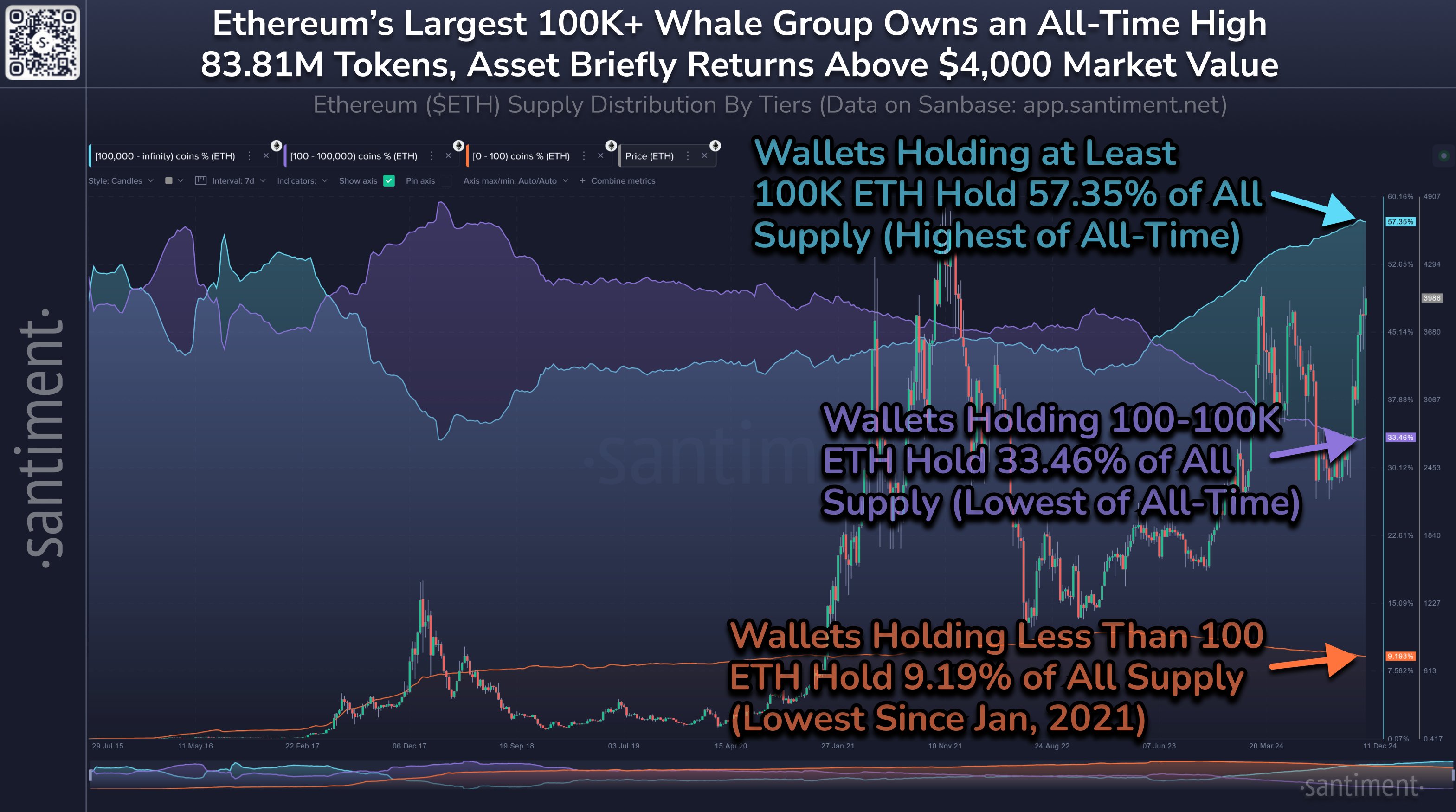

In a Tuesday tweet, Santiment shared that an exclusive caliber of Ethereum whales has amassed an unprecedented amount of the asset’s supply. Per the data, wallets holding at least 100,000 ETH now command a staggering 57.35% of Ethereum’s supply.

Consequently, the balances of other Ethereum holders have depreciated considerably. The market intelligence platform pointed out that whales holding between 100 and 100,000 ETH have dropped to their lowest-ever supply control.

The whales now hold just 33.46%, losing market share to large high-caliber holders. Meanwhile, retail Ethereum wallets – addresses with less than 100 ETH – have reached a multi-year low. The faction of Ethereum holders now commands just 9.19% of the asset’s supply, their lowest since January 2021.

Santiment Shares Market Implication

Following the disclosure, Santiment buttressed the market implications of the distribution shift. The platform noted that the increased stash among high-caliber whales is a long-term bullish signal.

Santiment acknowledged that staking platforms and decentralized finance (DeFi) protocols control a large portion of Ethereum’s supply. As a result, their continued accumulation suggests that they are locking away more of the asset.

Notably, this growing accumulation could create a shock if demand increases. Consequently, a demand shock will spur price upticks, favoring Ethereum investors.

Meanwhile, Ethereum has regained bullish momentum amidst sustained inflows from its US spot ETFs. The altcoin king has reclaimed the $4,000 price mark after an 8% weekly uptick.

At press time, Ethereum trades at $4,024 with a market cap of $484 billion.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.